Advent Portfolio Exchange (APX)

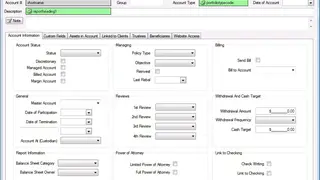

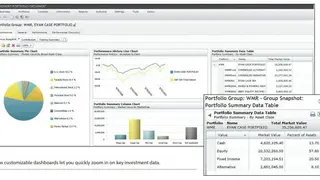

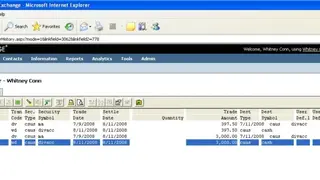

Advent Portfolio Exchange is an integrated portfolio management software that comprises the entire enterprise on its platform. It facilitates the company regardless of whether the firm oversees institutional resources, individual money, or a blend of the two. It influences an amazing, cloud-based arrangement that streamlines the portfolio of the executives and exchange work processes.

It helps its customers’ ventures into new business sectors, new locales, and new lines of business with certainty, diminishing operational danger and driving more prominent effectiveness. It can be used in workplaces of every kind. APX brings together the entirety of the portfolio of the customer and shows marketing information on one stage. Individuals can get to the data they need rapidly, with adaptable dashboards, a huge report library, and hearty custom announcing abilities. APX keeps the portfolio up-to-date and provides access to its clients 24/7. It engages them in interactive reports via their client portal.

Advent Portfolio Exchange (APX) Alternatives

#1 CXi-Registry

CXi-Registry is a fund administration software that helps an investor registry streamline and automate its back-office work. It is designed for multiple organizations to help them in fund management such as banks, insurance companies, and private wealth organizations, etc. This software is highly suitable to keep an account of any type of funds such as pension funds. The features it offers include activity tracking and asset management. CXiR’s secluded plan and administration based design underpin all types of the unit library just as new models. It provides exceptional services without compromising on system performance and security.

CXi-Registry is openly available software that offers its services for commercial purposes to all interested participants of the market. It is a cloud-based SaaS membership model giving a safe, financially savvy instrument for reserve supervisors and asset directors to meet their demands and administrative consistency needs. Additionally, its services include Real-Time Dashboards, Investor Portal, Customised Reporting, Streamlined Processes, Online ID Verification for investors and third parties, Multiple Fund Structures, and Worldwide Compliance.

#2 Riskalyze

Riskalyze empowers consultants to pinpoint a financial backer’s Risk Number and construct a portfolio that contains the perfect measure of risk. Their quick service and connectors exploit all that Riskalyze has to bring to the table and love to impart the mission to their consultants. It tells its customers the reasons why the investing links are broken and help them fix them. It guides its clients in controlling a hasty decision and supports a thoughtful decision in achieving their long term financial goals.

Riskalyze quantifies different types of investment-related risks to win the trust of their customers. It is the ultimate guide for fearless investors. It offers different types of quantitative services such as Riskalyze GPA which is the quantitative method to gauge the proficiency of assets and portfolios, and has become a ground-breaking approach to represent the relative benefit of one speculation methodology over another. It also maintains the risk profiles of its customers.

#3 HiddenLevers

HiddenLevers gives genuine business insight to C-Suites of financial institutions, customers, and productivity from the whole firm right down to the individual’s business. Its features include Firm Tracking, Risk and Revenue Statistics, Earnings Call Prep, Lending Due Diligence, Allocation Drift Tracking, Share Class, and Fees Optimization. With these features, it helps to report new customers automatically, accommodate net streams, and track the most productive counselors. It also views the Upside and Downside danger of the resources, incomes across a scope of macroeconomic situations. It produces a summary of the association’s risk and income scene with Automated Insights for Board of Directors, Analyst Calls, or Partner Meetings.

HiddenLevers utilizes huge information to quantify a huge number of connections between the economy and speculations. The model estimates the measurable connection between monetary levers and ventures, a few million relapses are processed as a component of this cycle. This platform empowers the estimation of more evident relationships, for example, the effect of oil costs on Exxon Mobil and the revelation of more subtle connections like the effect of vehicle deals on TV telecasters.

#4 Backstop Solutions Suite

Backstop Solutions Suite is a supplier of creative programming solutions for speculative stock investments, assets, benefits, rewards, private value firms, advisors, and family workplaces of all types and estimates across the globe. It plans and designs customized software for small firms to multi-billion dollar organizations. It helps its customers in making better investment decisions and offers fundamental tools to boost transparency and risk alleviation. With Backstop, one can follow documentation and drive more powerful correspondence through an incorporated framework, track and offer notes, gatherings, calls, and reports. It automatically synchronizes contacts utilizing Outlook integration.

Its services include searching all legitimate files and standard documentation utilizing catchphrases. The users can also send unlimited emails and coordinate into the work process utilizing auto-filling and watermarking sensitive records. Additionally, Backstop Solutions provide Implementation, Accounting, Design Services, and Custom Software Development. Ultimately, it helps its customers running their business more efficiently by achieving organizational efficiency and effectiveness.

#5 eMoney

eMoney is software that provides shippers an innovative source for their end-to-end encrypted transactions. Its comprehensive plan offers a user-friendly interface and it is specially designed for diverse growing firms. It empowers vendors to control their records without fractionalizing fundamental pieces of their business. It removes the need for a third party in the payment process and provides 24/7 customer service. eMoney wipes out different sellers and improve valuing, with the accommodation and security of an answer given by a solitary organization. The application permits its user to create Campaigns and send eGiftCards, eDeals, eCoupons, and eInvoices straight to its clients’ emails as well as to their cell phones.

eMoney allows its customers to accept payments anytime and anywhere around the globe via electronic funds transfer. Its customer engagement and reward platform give different benefits to its loyal users, such as loyalty points which can be exchanged for shopping.

#6 SimCorp Dimension

SimCorp Dimension provides integrated management solutions to its customers to ease their way in successful investments. It helps to overcome modern challenges like increasing regulations and reporting requirements. It keeps track of the trends in the industry and offers a flexible system that fits into everyone’s requirements. The interesting feature is that it keeps the system up-to-date and supports clients in achieving their goals. One who wants to bring value to his organization can ask for their consultancy services at any time.

The integrated system of SimCorp Dimension includes managers of every kind like Enterprise Data Managers, Asset Managers, Strategy Managers, Investment Accounting Manager, and many more. They all collaborate with each other in making the business of their client successful. With numerous speculation chiefs actually working in an interwoven of single-reason IT frameworks that aren’t associated, they offer a streamlined arrangement that actually fulfills the entirety of the necessities of the customers.

#7 Morningstar Advisor Workstation

Morningstar Advisor Workstation helps people settle on better speculation choices all alone with evenhanded, free information, and investigation. Its cooperative board arrangements help people and experts arrive at their objectives and contribute for the long term. The information, exploration, and innovations give experts the certainty to decide for their representatives, establishments, and customers. It is a worldwide pioneer in security-level ESG examination and appraisals that help institutional resource supervisors and proprietors around the planet with the turn of events and usage of reasonable investment techniques. It offers to invest solutions by doing autonomous, exhaustive assessments on values, reserves, and investment products. Its services include financial planning solutions, research, goal setting, manager selection services, investing, and reporting solutions.

It also offers online assistance for businesses to help their representatives save and put resources into their work environment retirement accounts. Its strategic solutions help their clients to reach their long term goals.

#8 Morningstar Office

Morningstar Office helps investors, advisors, retirement professionals, asset managers in working with the market information smoothly and provides them a risk analysis by examining the market fluctuations. It processes and provides a clear analysis of the information needed by the customers and gives them an idea of where and when it is safe to invest. It also schedules billing so one can plan it ahead. The billing framework can be customized for every firm according to the manner they work.

This platform makes it simple for its clients to proficiently run their organizations. The customers become able to make the decisions confidently after consultation with the Morningstar Office. With this software, one can have access to the latest information and trends of the industry. It offers an interactive portal where customers can contact Morningstar Office, get future insights and updates which help them in remaining focused on their goals.

#9 Ziggma

Ziggma helps the dynamic financial investor ceaselessly endeavoring to improve his/her portfolio. It supports the hands-off investor who is searching for a helpful method to be on top of portfolio risk and improves organizations’ monetary activity. The deft financial investor who effectively exchanges an enormous number of stocks can excel on account of Ziggma Smart Alerts and the best free stock screener and the portfolio the board device. It also offers novices to profit by the Ziggma model portfolios and stock scores.

Its instinctive portfolio visuals pass on data viably. The creative checking apparatuses of Ziggma helps in saving the customers’ time. The platform offers a connection to one’s venture records to Ziggma to help keep him steady over his portfolios. It processes the market-driving monetary information and execution scores for stock exploration. One can utilize their model portfolios to benchmark and discover motivation to becomes successful in their ventures.

#10 Pershing Financial Services

BNY Mellon’s Pershing gives worldwide monetary answers for counsels, resource administrators, specialist vendors, family workplaces, reserve chiefs, enlisted speculation consultant firms, and abundance directors. It is a business-to-business supplier that helps its customers power their business and expand openings. It considers its clients as pioneers in their fields and when the customers develop trust in their services, they pick Pershing Financial Services as they are the innovators in their field.

Their prime services include the solutions for every problem like financing, retirement and execution solutions, etc. One can also benefit from their marketing and practice management which claims to be the best in the market. The trading services and wealth solutions provide world-class trading expertise to its clients. It allows trading in 60 markets and accepts local and foreign currencies especially US dollars. The automated online tools it offers, maintain accuracy and increases efficiency over time which makes it extremely useful for its users.

#11 Croesus Advisor

Croesus Advisor has been giving portfolio based programming and business knowledge-focused services to the monetary administrations’ industry in North America. It is easy to understand, superior, and a very inventive and high-performance software. It highlights progressed instruments to safely and effectively oversee customer resources for abundance the executive guides. Its services include Data Analytics and rebalancing.

Croesus Data Analytics gives a unique visual interface to counselors, branch directors, and heads of departments to develop experiences into key business and execution measurements while Croesus iBalance gives direct, customized, and consistent portfolio rebalancing. It is solid and adaptable to give you more opportunity for customer confronting exercises and business improvement while guaranteeing consistency with the customer and administrative imperatives. It sends the financial data with foolproof security so the customers don’t have to worry about their privacy. This platform provides an unmatchable experience by actively responding and solving the queries of their clients.