Dryrun

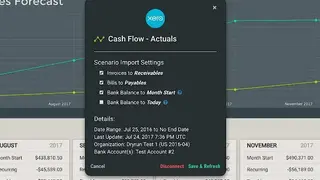

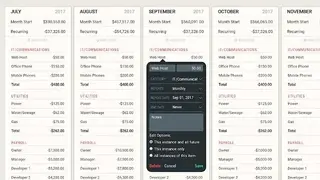

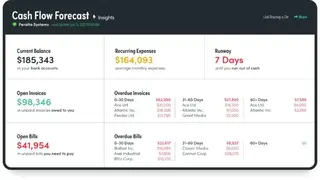

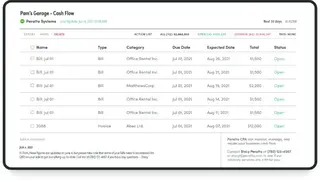

Dryrun is a cash flow forecasting software that helps you plan business growth, and see all your cash flows on one page, with every dollar, accounted for in black and white. It has been created especially for small business owners so that they could focus more on their core business rather than worrying about cash flow. Whether you’re a project manager, consultant, or entrepreneur, Dryrun’s feature set can support your business simply and effectively.

This makes it easy to prepare for future cash flow events, so you can plan ahead and avoid stress. If you have ever wondered how much money you’ll have at the end of the month or how much operating capital your business will need to scale in the future, Dryrun makes it easy to find out. You can create forecasts for any upcoming event, whether it’s a customer purchase, a salary payment to an employee, or your own personal monthly expenses.

Dryrun Alternatives

#1 Strands BFM

Strands BFM is a Business Financial Management solution that helps SMEs track, analyze and manage their finances in a user-friendly environment. With this solution, you can easily manage day-to-day operations and decision-making. It allows you to be proactive and keep control of your business finances. The application can be accessed through any browser or device, regardless of location, while keeping data synchronized and secured in real-time.

Monitoring customer payment history, managing employee payments, invoicing, and credit facilities management are just some of the functionalities of Strands BFM. The application also makes it easier to manage cash flow from its cash pool application, allowing businesses to plan better for the future. It provides a set of tools to run your business, optimize your accounting and financial processes, and process and manage all your financial data, including cash flow and credit, forecasts, and budgets. All in all, Strands BFM is a great tool that you can consider among its alternatives.

#2 Cash Flow Frog

Cash Flow Frog is a money management system that helps people take control of their personal finances. It also assists small businesses in managing their business finances. The program uses a visual metaphor to make it easy to understand your cash flow, provides insights and tips on how to improve it, and a holistic approach that will help you create or recreate your financial goals in order to be financially free.

It is similar to traditional budgeting software, except that it allows you to see the cash flow of your business from a frog’s eyes perspective. It also helps you to have better cash flow management by reminding you to do things in advance, like pay your rent or any other expenses which are due at the end of the month. You can use it to track your cash flow month-by-month and understand where exactly (in which months) you are going to have insufficient cash.

#3 SAP for Banking

SAP for Banking is a banking software that automates the whole banking activity. The software is used by financial services companies and is available in multiple variants. It offers a wide range of applications which automate back-office operations and support customer-facing processes. This software provides all the solutions for the banking activities and financial services of a bank ranging from investment, trust, and mutual fund, personal and business banking, corporate banking, retail banking, and treasury management.

It can be used for defining and managing various aspects of your SAP for Banking solutions with zero coding, as well as helping to share new business processes you’ve created with other users. What differentiates SAP is the way we approach banking; as a strategic business partner, a digital innovator, and a go-to expert for trust, compliance, and data. It delivers a safe, reliable, and profitable customer experience across all channels.

#4 Payference

Payference is a cash flow and treasury management service that allows you to manage cash flows, expenses, and taxes. Its products include a payroll service that enables small and medium-sized enterprises to save on expenses and taxes by outsourcing their payroll management to a third party. The software also provides an online account that allows its users to conveniently manage their cash flow and expenses, with real-time access to the details of their finances from any device.

The software automates idle balances, manage receipts, monitor expenses, and forecast future cash. Improve your working capital and reduce the time wasted in administration. Payference user can manage their invoicing from anywhere in the world, doing it all from their desktop, laptop or tablet anywhere, anytime. Payference’s comprehensive cash flow management tool helps you to manage the timing of your payment in order to find the optimum time to pay the invoice.

#5 CashController

CashController is a financial cash flow forecasting program that helps small businesses take control of their cash flow, free up working capital, and ultimately grow their business. Re-forecasting is an important and common business practice for projecting the cash flow of any given business. CashController includes a variety of financial cash flow reporting tools that can be easily customized to meet your specific needs. Whether you have one project or hundreds of contracts, the following tools can help you get a better handle on your cash flow.

The software is for business owners, financial managers, and entrepreneurs who want to control their cash flows. It enables its clients to deal with the monetary uncertainties of running their businesses. It helps everyone from private small business owners to medium and large business companies with their financial cash flow operations. Moreover, you get real-time reports, expenses, and revenues tracking and forecasting, invoice management, categorization, and planned vs. actual performance, to name a few.

#6 PROFITS

PROFITS is a financial software and business intelligence solution composed of different e-business tools that give the owner a complete picture of his/her businesses and customers. The web-based application has a database that can be interfaced with by any other local or remote applications, such as those used by the hotel’s human resources. Full integration with internet booking systems gives users the ability to accept reservations and manage the availability of rooms.

The application has been developed targeting the management needs of diverse company aspects; front office, email marketing, real-time access to financial information, integrated with the full accounting system, reservations, point of sales, and purchasing. A full accounting system allows immediate and real-time access to financial information for decision-making purposes. Some modules are specifically designed for the unique tax code and filing requirements of each state and local jurisdiction; the business-specific tax engine account for all tax liabilities, credits, and refunds specific to the industry, location, and taxpayer. It even provides yearly reminders to file required returns and warns of upcoming filing deadlines.

#7 Temenos Transact – Core Banking

Temenos Transact – Core Banking is a Banking and finance software that delivers off-the-shelf functionality for high-volume transaction processing and provides a paradigm-shifting approach to the banking application. All the functionality needed for a successful transaction processing operation is available out of the box in one flexible package. A single, unified software platform means less complexity, greater harmony, and higher efficiency. The features you need to run a serious bank business are all there and ready to be configured by your own business experts for your own business goals. This is how we make the integration between your legacy banking application and Temenos Transact as smooth as possible.

It combines advanced core banking capabilities with customer-focused products and business intelligence to empower an organization of any size to compete in today’s changing financial marketplace. It’s at the heart of your business, whether your customer is an individual, corporation, or government agency. You get a combination of tailored, robust, and flexible products with advanced functionality that includes everything from basic portfolio management to complex, multi-currency cash management and trade finance.

#8 Moneto

Moneto is a finance management software that helps you manage your finances and your business. It aims to help you record every value coming from your company, so you can start reporting, forecasting, and planning your activities better. It is a single application for managing your accounts, generating invoices, managing your expenses, and getting online payments from customers. Using Moneto, you will be able to track expenses and get regular insights into your personal financial health.

It is also a powerful tool that our customers use to manage their spending, savings, debt repayment, and other financial goals. In order to do that, it has developed an easy-to-use, flexible online platform that will flexibly adapt to your personal financial situation and habits. So the next time you want to use your money for something besides eating out, buying new shoes, or going on vacation, try Moneto and see how it helps you make better financial decisions.

#9 Akoni

Akoni is a Cash Management software that helps businesses manage their cash flow, increase productivity, save time, lower costs and grow their business. It’s designed to make retail business more effective and efficient through a wide range of features. It offers tools for managing and optimizing your accounts payable cycles, improving your collections process, automating your payroll process, and more.

The cloud-based document management system can be used to manage all important business documents, from tax information to contracts to receipts. A comprehensive dashboard gives you an overview of your business with in-depth analytics for measuring your success. But it’s not just about numbers; Akoni also offers user-friendly tools for running leaner and smarter, such as automation that allows you to set up automatic approvals and reoccurring payments. All in all, Akoni is a great tool that you can consider among its alternatives.

#10 Capchase Expense Financing

Capchase Expense Financing is a finance management software that helps you manage your expense, control your already spent money, control your budget and set a budget for your next month. By different features, it allows creating a better financial control. Plan your expenses by categories and make a budget for next month; Track all expenses on the go with timestamps, location, and photos. Analyze your spending by categories or days; Save money by easily adding photos to your expense items.

Receive visual statistics about your spending in one tap; Set how much you want to spend in categories for next month and be notified when you exceed. Get control over your expenses with our financial reports. With Capchase Expense Financing, you can offer your employees reimbursement benefits and manage their expenses online. You can also offer your employees reimbursement benefits and manage their expenses online. The program also lets you categorize your expenses and incomes for a better overview.

#11 AGICAP

AGICAP is a Cash flow management software designed specifically to help individuals and small businesses manage their cash flow, record their transactions and make more money. It is a great tool for small business owners, contractors, workers, and anyone who wants to learn how to manage their personal cash flow. Using this software, you can easily create a budget and manage your cash flow.

When you are managing a business, you will be able to easily track your expenses and income from day to day and from month to month. You can see how much money is coming into the business and where it is going. You will also be able to see your profit and loss statement for a particular time period which eliminates the need to have separate software for this purpose. The software is easy to install, and it takes just a few minutes to set up. You can easily access it from anywhere as it runs on Cloud-based system.

#12 Tesorio

Tesorio is a web-based accounting and finance platform that offers a comprehensive set of features, including invoicing, forecasting, time tracking, and reporting. The application helps entrepreneurs, small businesses, and freelancers to keep up with their invoicing, accounting, and taxes. This is a new way of doing A/F from the comfort of your laptop or mobile phone. It is a flexible tool that allows you to work seamlessly as a team or by yourself.

In order to overcome the obstacles of accounting and taxes in digital marketplaces, you have to be prepared to adapt and find solutions. The tool provides several services to become an entrepreneur, to help you manage your business, to have a business plan, and it’s very easy to use. You can find other businesses and compare them with yours. There is a section where you can find suppliers and add them to your competitor’s list.

#13 Fathom

Fathom is an intuitive and easy-to-use reporting, analysis, and forecasting software that empowers analysts and business executives to make data-driven decisions with clarity. It’s a cloud-based business intelligence tool that allows you to create and share customized dashboards, reports, and visualizations. With the software, you can import almost any type of data, unify it into coherent business metrics and generate reports that are visually appealing.

Fathom also makes it easy to share insights with your team. For a fraction of the cost of traditional accounting software, Fathom offers a simple yet powerful and interactive web application for small businesses to track and measure their business performance. This makes it easy for entrepreneurs to run their financials like a large company does, with real-time, visual data. They can now make informed business decisions on which to base smart growth strategies. And in less than a minute!

#14 Primetric

Primetric is a project, resource, and financial management platform that helps teams plan, manage, and execute their projects. With this tool, teams can organize tasks, manage deadlines, track progress and stay accountable to their goals. It aims to address two important issues that administrators, managers, and leaders face on a daily basis. First, the inability to efficiently track and manage resources, and second, the inability to maintain financial transparency without having to rely on a third-party financial institution.

Primetric helps you to plan and track projects and organize the tasks for you and your team. You can manage your time, tasks, and finances of your projects, keep track of your time online, and create reports to see how much money you spend on each project. On Primetric, you can create as many projects as you want and invite your team to work on them. The software is designed with adaptable modules to help streamline your business process.

#15 Cashbook

Cashbook is a cash management and automation software having features like check printing and processing, terminal management, electronic payment acceptance, electronic credit memo generation, and many more. The solution is suitable for any business that sends out several invoices per day and needs to track when these have been paid, manage employees’ salaries and automate recurring payments such as deductions from salaries. The solution can be used by businesses from all types of industries such as IT, consultancy, legal, BPO, KPO, and services that need to manage their clients’ invoices and automate payments without the need for human intervention in the process.

The benefits are Reconciliation of bank account with a click in a few minutes, Managing cheque & cash transactions with a click, Free credit card swipe and track your expense, Real-time alerts for low balance, zero cheques, expired card, etc., Real-time reporting on cash flow, and other business insights, Error alerts for duplicate entries, large amount errors, etc. and more

#16 Float Cash Flow Forecasting

Float Cash Flow Forecasting is a cash flow forecasting software that allows you to accurately forecast your cash, manage budgets, and track actuals all in one place. It is easy to set up and use, has rich reporting, and allows you to automatically sync forecasted numbers with your accounting software. Float also has powerful analytics and forecasting tools that allow you to give your business the data it needs to succeed. It helps in visualizing how different changes to assumptions affect the cash flow projections.

The upcoming outputs are compared with the original projection to check for consistency. A company can use this software to perform financial planning, test different business strategies, and identify the most productive business options. Advanced modeling techniques are used to forecast the ongoing cash flow variables, such as the sales volume, selling price, and expenses. The user-friendly interface facilitates easy input of all the relevant parameters, including lease rentals, sales expenses, and others.

#17 Cashforce

Cashforce is a cash forecasting and working capital analytics platform for small to mid-sized businesses that enable companies to see what their sales, expenses, profits, and a credit will look like in real-time using data from their existing systems. With hundreds of thousands of data points generated, Cashforce’s patent-pending analytics has been proven to optimize cash flow and increase profitability by up to 30%. Save cash through improved cash forecasting accuracy realized by smart logic & AI/ML, easy actuals vs. forecast analysis.

Moreover, you can seamlessly combine different sources like bank statements, ERP, TMS, forecasting logics, and manual uploads, and include additional financial data such as CRM or order management systems, budgeting systems, sales projections, etc., and unlock the true value of your data.

#18 Finmap

Finmap is a cash flow management tool that automates invoicing, expenses, and payments using artificial intelligence and machine learning. It makes cash flow management simple and saves time by helping users create invoices automatically. The software uses algorithms and data analysis to monitor spending and identify trends in spending. Additionally, users are able to set a budget and control their spending.

It allows for an individual to upload transactions from accounts and classify these transactions based on their purpose (mutual fund investment, car loan, mortgage payment, etc.) The remaining funds are split between savings and a line of credit to ensure that appropriate levels of liquidity are maintained. Finmap provides real-time balance information and detailed reports regarding the user’s financial situation. It was designed with the user in mind: it is intuitive and simple to use, with a focus on both form and function.

#19 Oracle FLEXCUBE

Oracle FLEXCUBE is a unique, smart, and modern-day universal banking solution that implements innovative changes to a bank’s key systems and allows them to deliver the best customer experience. You can improve the experience of customers, offer value using this highly versatile product built using cutting-edge technologies. It provides automation and intelligent decision-making to help you accelerate growth thanks to its usage of NLP and Machine learning tools. You can easily integrate with multiple third-party products. The best feature is that it offers multiple deployment options like cloud and on-premises, allowing you to choose the one that meets your requirements.

#20 Finacle

Finacle is one of the most trending banking software which consists of various exciting feature and offers a separate module for every department in the banking system. The primary function of the platform is to provide you with multiple modules that can integrate a cloud-based system for your financial operation.

The interface is easy to interact with and give a constructive layout which guides the user for easy navigation. The platform works around the financial core banking solution to provide you with a digital engagement suite. It also provides corporate banking facility, cash management module, comprehensive front to back digital banking solution with advanced architecture, online banking platform, and much more.

The ease of access and the layout both offers business requirements for retail stores corporate and universal banks and also create a maximum opportunity for growth transformation on a large scale. Finacle gives 24/7 customer support and has excellent features such as corporation of investment modules, compliance tracking, online banking, retail banking, security management, private banking, transaction monitoring, etc.

The platform is the only cloud-based software and does not give any program for the operating systems on mobile devices. The price of Finacle starts form $500000, and the size of the company depends on the pricing factor.

#21 NLS Banking Solutions

NLS Banking Solutions is a smart banking solution that consists of various modules that work to integrate your core banking software and also give you multiple opportunities to handle different financial organizations. The interface is sophisticated and comes with a nice module that includes various solutions for business automation and digital banking.

It also gives users multiple facilities to integrate with the banking system. It comes with the user-guided structure and provides many facilities that include a package of system integration and various software module that provide ease in every operation.

NLS Banking Solutions is only available on cloud-based devices and also gives a dedicated software for Windows operating system. After installation, it provides a training module and online support that offers a 24/7 live agent facility for guiding you through various steps and helping you in any technical problem.

The core features include transition monitoring, private banking, multi-branch handling, compliance tracking, security management, retail banking. It also includes ATM management, investment banking management, and online banking management system.

#22 CoBIS Microfinance Software

CoBIS Microfinance Software is a micro-finance and handling software that gives you very is a module that includes robust micro-financing and micro banking operation. The program has a sophisticated interface and offers the user with account management system client supporting supplier and loan portfolio to the financial planning reports, and much more.

It is easy to use and only available for cloud-based devices, but the desktop-based software is on-demand and for large Enterprises. CoBIS Microfinance Software work around six main modules that include the timely development of services, journal ledger, accounting software, smart banking functionality, customization request, user-friendly look, and browser compatibility.

Using these factors, the platform provides various combinations of solutions and integrate companies from time to time and manage their financial records easily. CoBIS also offer free demonstration version and for large enterprise on Windows operating system. The interface has a smart user manual for training and provides 24/7 technical support for solving your problem.

The key feature of the program includes ATM management, corporate banking, investment banking, online banking, retail banking, securities management, compliance tracking, multi-branch integration, private banking, risk management system, transaction monitoring, and much more.

#23 CPB Software

CPB Software is a smart booking software which provides facilities for many industries and authorities and also works with the various financial organization and provides the solution to manage their business module and day-to-day operations.

This software gives you complex Information technology modules, specialization, and provides services that include a beautiful structure with integrated complete standard software. The program works amazingly with financial institutions and offers a whole range of requirements and tools for the international market.

CPB Software offers comprehensive solutions and provides individual components and standalone solution for small businesses. It is known for its security aspects and provides a competitive feature that includes a security management section, retail banking, online banking, investment banking, and corporate banking.

The program also provides compliance tracking, multi-branching, private banking, transaction monitoring, and various other modules. It is available for cloud-based systems and does not give any program for windows OS or any mobile devices. It has an excellent interactive layout and provides a user-guided structure. The pricing starts from $175000 for a one-time purchase, and the program will keep updating.

#24 FMS.next

FMS.next is a smart baking platform which gives many facilities for integrating global financial institutions, and it is a business startup that provides facilities for universal banks, private banks, Islamic Bank, leasing institutes, and various other platforms. It has a remarkable interface which works beautifully and includes a peer to peer lending, a crowdfunding platform, alternative banking, Finance organization, and multiple banking facilities in one single software.

FMS.next consists of an interface that provides flexibility, ease of use, cost-efficiency, and flexible design. It also customizes the interface according to user requirements. It also provides a separate API that consists of a user dashboard for employees and supervisors to review every performance and other functions under the system.

The program is available for the cloud-based module, gives mobile applications, and also gives a dedicated software for installing the program in the Windows operating system. It also comes with online support and training module that provides a guideline structure.

The core features include ATM management, multi-branching, credit management, compliance tracking, corporate banking, investment banking, and various other functions. Online banking, retail banking, security management, transaction monitoring, risk management, are also some of the main tasks of FMS.next.

#25 Core Banking Solution

Core Banking Solution, as the name suggests, offers a banking software that comes with various facilities and offers a guaranteed solution for day-to-day business with secure encryption and straightforward design, which work according to user requirements. It can handle multiple transactions simultaneously and provide an article report on day to day transactions.

This software helps you in organizing every management module in the banking operation and gives you a remarkable interface. It enables your financial institution to not only operate in an efficient way but in a most cost-effective way.

Core Banking Solution provided services for various operating systems and platforms but only offer an iOS application for mobile devices. It also comes with the 24/7 live representative who can solve your technical problems and also guide you through the training module, which includes in-person training webinars documentation and much more.

The essential functions include compliance tracking, ATM management, investment banking, multi-branching, online banking, private banking module, retail banking, risk management system, security management system, transaction monitoring module, and much more.

Core Banking Solution can be the best choice for small organizations because it can handle day-to-day business and also give you a customizable dashboard with interactive tools that provide you a progressive system for your financial needs.

#26 OLYMPIC Banking System

OLYMPIC Banking System is one of the renowned banking systems and provides a core banking solution that works in the best way. It has a sophisticated interface, and the program is available for cloud-based modules and offers dedicated software for Windows operating system.

The expertise of the software is in retail banking, private banking, wealth management fund, and trust and also provides its services in central banks. The system is interactive and includes a smart information system that incorporates front and back offices for monitoring tools communication systems. It gives control to the single user and offers high-end security and authentication protocols.

OLYMPIC Banking System gives a training module that includes in-person training, live online webinars, and documentation. It helps the firm and its employees to know about the distance integration and functionalities, provides insight into how every function can utilize its extent. The core features include ATM management, investment banking, online banking, security management, retail banking, and corporate banking.

Compliance tracking, credit card management, multi-branch, private banking, risk management, and transaction monitoring are also some of the central aspects of the platform. OLYMPIC Banking System comes with a friendly interface with an attractive module and constructive design. It also supports the user with a 24/7 live technician represented for understanding the modules and technical help.

#27 Capital Global Banking

Capital Global Banking is one of the most sophisticated banking software which gives a complete management module, and transaction monitoring features, so you can get the best experience for managing every business process in a single system. It provides a core banking facility and also gives you modules to integrate private banking, anti-money laundering, fraud detection protocols, and various other features.

The program has a remarkable interface that comes with a user-friendly navigation system and offers a constructive layout for ease of use. It comes with features that include ATM management, system compliance tracking, investment banking, multi-branch operation controlling online banking. Other features of the system include retail banking, security management, transaction monitoring module, risk management, and more.

The software works around the portfolio management and multi-asset trading, check management, customer relationship management module, which also works in a beautiful way of providing the functions to boost up the business, generate leads, and keep track of your employees and customers.

Capital Global Banking comes with the 24/7 live agent support, but it does not give a module for installing the software in your desktop-based operating system but give you a server and cloud-based access. The starting price of the platform is $500000.

#28 iMAL

iMAL is financial software that works for banks and investment firms and offers facilities for every type of financial organization. It has a friendly interface and provides various tools and gives its services for more than 140 Islamic financial institutions in three different languages across the Middle East and the major Asia Pacific.

It is currently working in 39 countries and provide complete enterprise Islamic banking and investment system. It works for the powerful core banking platform specially built from the ground up to support the Sharia banking operation and work with the vertical application for delivering a required outcome.

The program design is sophisticated as it can handle complex requirements for the institution and work according to the operating procedure in any region. iMAL is available on multiple operating systems that also include cloud-based systems and mobile applications. It comes with the user manual and a constructive layout and interface that has a beautiful design and provides ease of access in interaction.

The platform also supports ATM management, complies tracking, Corporate Banking, multi-branch handling, investment banking, online banking. It also works with the private banking sector, retail banking, securities management, transaction management, risk management, and much more. iMAL also provide 24/7 Live support.