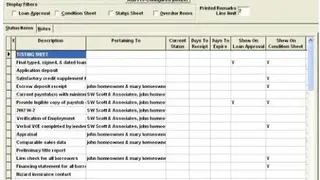

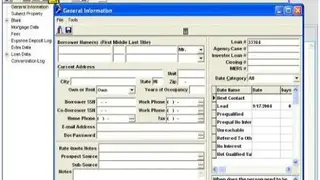

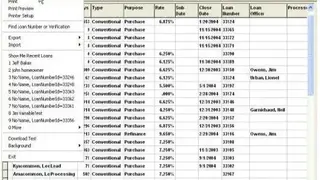

PCLender

PCLender is an application that provides simple and elegant web-based mortgage solutions for local banks, credit unions, and mortgage bankers. Proven to deliver immediate ROI, it is the most cost-effective lending solution. Owned and operated by Mortgage Bankers, it works collaboratively with clients to dynamically fit into the world in which they lend. The platform is a comprehensive web-based solution that provides the ability to apply online, create, process, approve, close, and disburse loans to investors. The cost-effective solutions provide a continuous process that can be customized to the specific needs of mortgage lenders and is implemented within 30 days.

PCLender Alternatives

#1 LaserPro

LaserPro is a consumer lending solution that enables you to process consumer applications from cross-selling to close while maintaining credit compliance. The platform works for its clients and the client’s satisfaction is its concern. This great platform gives you the ability to disburse loans without delay. It has the possibility of financing the campaign and developing a strategy to promote its clients’ products. It allows you to make all documents quickly, easily, and efficiently. The interface of the application is simple, user-friendly, and can be customized according to the needs of companies.

#2 Encompass Digital Mortgage Solution

Ecompass is a one-stop integrated solution that covers the entire loan lifecycle and provides a record system that allows you to close compliant loans. It allows your buyer to see everything when applying for a mortgage. They see their rate, payment, and closing down to the last cent. It will also walk you through the qualification process for your buyer and make sure every item is discussed with the buyer.

You will experience immediate savings and operational improvements. Lenders of all sizes rely on the Encompass Loan Origination System (LOS) to disburse more loans, reduce costs, shorten closing times and make smarter business decisions.

Encompass LOS allows loan officers access to everything they need to disburse and close more loans in less time from anywhere. With AI-based intelligent automation built into the entire system, lenders can respond more quickly to inquiries and improve customer service. And with built-in paperless workflow and next-generation data security, ensures that both lenders and borrowers are prepared and protected.

#3 Floify

Floify is a mortgage industry automation solution that streamlines the loan disbursement process by providing a secure communication and document management portal that is shared by lenders, borrowers, real estate agents, referral partners, and other stakeholders. Mortgage brokers and loan officers use this platform to digitally collect and verify borrowers’ documents, track loan progress, connect with borrowers and real estate agents, and close loans faster and easier than ever.

The platform also includes an easy-to-use 1003 mortgage loan application that can be embedded on the lender’s website, customized and easily synchronized with the related loan file, allowing lenders to provide fully branded and efficient mortgage services. As a borrower’s application progresses to the underwriting stage, it informs borrowers and other interested parties of loan status changes via automated email and text messages. The platform’s responsive design works great in mobile web browsers. The platform is also available through mobile apps for Android and iOS devices, so users can view the loan file and download additional documents from anywhere in the world.

#4 Calyx Point

Calyx Point is a cloud-based credit service platform that helps users with credit and marketing processes. It is used by industry leaders in finance because of the various features the site offers. The platform comes with product documentation, guidelines for marketing, disbursing, and processing credits. In addition, it offers telephone and email support. It is a recognized provider of relevant mortgage software solutions used by banks, credit unions, mortgage lenders, and brokerage firms throughout the country.

The company’s easy-to-use technology, including an online borrower interview, loan disbursement systems, and secure e-signature software, is designed to streamline, integrate and arrange all stages of the loan process for clients of various sizes, workflows, channels, and complexity. The platform comes with a variety of tools like Point, Portfolio Producer, Calyx Network, INK-it, WebCaster tools, and many more. Point features include monthly SaaS pricing, templating, lead database and pipeline management, sales and loan checklists. The platform’s WebCaster tool allows users to integrate with Point and PointCentral for Google Analytics tracking. INK is an electronic signature tool that allows users to prepare borrower forms at Point and PointCentral.

#5 Encompass360

Encompass360 is an application that helps you to organize and update mortgage documents while running your lending business, keeping and updating all relevant documents, numbers, contacts, and statuses in a single package, and providing digital GFE and HUD-1 forms for filling and maintenance. Automatic tracking of information disclosure is available.

The platform is designed to help mortgage lenders manage their original business and respect various federal and state regulations. It includes the latest GFE and HUD-1 forms. Warnings and automatic disclosure tracking will help you to keep RESPA compliant. The application allows you to more efficiently manage your sales and marketing, and create and close loans faster. It also includes enterprise and branch management capabilities, secondary marketing and trade functions, and tools to help you organize your work, the pipeline, and your time more productively.

#6 TValue

TValue is a depreciation solution that helps businesses manage loan and lease structuring, track loan details, generate quotes, and more. It is a cloud-based depreciation solution that helps businesses perform calculations, track loan details, determine balance sheet amounts, create quotes, and contracts through integration with Salesforce. The platform is easy to use and contains many applications for calculating loan payments, annuities, etc.

It is an inexpensive, versatile, and comprehensive application that saves your time. For mostly loan repayment schedules it makes it much easier to track principal and interest payments in real-time without waiting for a statement. The salient features of the platform include an Amortization schedule, Auto Loans, Collection Management, Construction Loans, Investor Management, and Loan Processing.

#7 LoanSoft Pro

Loan soft Pro is a comprehensive mortgage lending solution. It is designed to help you organize, track and process your mortgage loans quickly and easily. It calculates DTI and creates mortgage tables for various loan programs that indicate what interest rates your borrowers can afford. The smart payment adjustment feature allows you to manually adjust the debt-to-income ratio and the software will tell you what interest rate/payment with a specified DTI the borrower can allow for certain loan programs and interest rates.

This is a very useful tool when pre-qualifying for a refinancing or purchase loan. The document storage feature allows you to store documents for each of your clients in a client profile, allowing you to stay highly organized. Store w-2 client papers, payment receipts, tax documents, 1003 papers, borrower permits, contracts, and more. The contract fill function allows you to download the contract into the software and use it for each of your borrowers. The program will automatically enter information about the borrowers in the contract you specified.

For example, if you have a consulting agreement that you need to send to each of your borrowers, you simply load it into the software and choose which client you want him to fill out the information for. The program will then instantly fill out a contract with customer information for you. You can take the contract and send it to your client. This feature will save you time and make the whole loan process easier for you. This feature allows you to download and export an unlimited number of contracts.

#8 Finflux

Finflux is a cloud lending platform to accelerate the transformation of your lending business. Its vision is to create affordable and fair financial access for individuals and businesses around the world. Finflux Cloud includes a complete suite of products to help manage the entire loan lifecycle. Its products include lending, credit management, financial accounting, market integration, app-based lending, data-driven alternative credit scoring, dashboards, reporting, and analytics. The platform’s clients include non-bank financial institutions (NBFC), microfinance, SACCO, banks, financial companies, fintech, business correspondents, aggregators in the making, agent networks, and many more. It helps financial institutions stay ahead of their business by delivering next-generation digitalization products, workflow automation, and secure loan products.

Today its products are trusted by more than 60 financial institutions around the world. It serves about 6+ million borrowers with an active loan portfolio of $ 9 billion. It has a long way of trust with clients in 15 countries and has received two international awards for its services. The cloud-based platform empowers field staff to make the right lending decisions. Finflux Cloud comes with many must-have integrations and market connectivity to reduce time to market. It has a vision of democratizing lending so that people can borrow to make their dreams come true. The platform is intuitive so that lenders can offer their borrowers easy-to-use products. Having a simple platform also helps to focus more on customers and their happiness. It also offers its customers flexible, use-based pricing.

#9 Student Loan Servicing System

Student Loan Servicing System is a web-based service that provides customer service for your federal student loans. This tool answers your questions, offers solutions if you have payment problems, and processes your payments. It helps you to acquire student loans very easily and appropriately and everything is very easy to navigate. Paying off your loans is very fast and efficient because it prompts you to make a payment from the very first screen.

It is easy to change repayment plans, and it breaks them down for you. Their customer service is always pretty quick and they answer all your questions in depth. The salient features of the platform include Accounting, Amortization Schedule, Automatic Funds Distribution, Collateral Tracking, Collections Management, Compliance Management, Document Management, and Loan Processing.

#10 LendingSpace

LendingSpace is a lending solution that helps you manage your correspondent lending channel and transfer loans to the secondary market. The platform offers mortgage disbursement software solutions that contain the tools needed to create regular, federal housing administrations (FHAs), veterans’ affairs (VAs), and reverse mortgages in one system. It primarily serves mortgage lenders, credit unions, and public banks. The platform is easy to use and streamlines all the processes. It provides great tracking and loan servicing. It is easy to navigate and convenient for both the user/lender and the borrower/client.

#11 DecisionLender

Decision Lender is a cloud-based consumer lending solution that helps credit unions, banks, and finance companies automate the lending process. With a customizable dashboard and analytics, the platform allows users to handle all types of loans, including direct, indirect, retail, and commercial. The platform allows online and mobile lending, as well as opening a deposit account. It serves as a real-time business monitoring tool and includes automated underwriting, forms and contracts, exemption tracking, electronic signature, online document sharing, individual dealer ratings, application tracking, and more.

In addition, it provides role-based authorization, automatic counter-letters with offers, and user-defined rules for gaining insight into transactions through analytics. It integrates with in-store kiosks, Dealertrack, RouteOne, and CUDL to help simplify digital processing and storage of information. The pricing is available upon request and support is provided by phone, email, and online support.

#12 LoanSphere Empower

LoanSphere Empower is a state-of-the-art Loan Disbursement System (LOS) that provides functionality for all aspects of the disbursement process, from point of sale to closure. It is available as an ASP or as a standalone solution that supports retail, wholesale, and consumer channels registration and closing of a loan, pre-and post-closure audits, and compliance functions like product and prices, electronic document management, and industry-standard interfaces. The platform provides functionality to create both early mortgages and home equity loans and lines of credit, helping to ensure data integrity and security, eliminate errors, increase transparency, and reduce the complexity of managing multiple systems.

#13 Mortgage Builder

Mortgage Builder is an application that provides enterprise mortgage software solutions for modern lenders that empower teams, quickly adapt to changing rules, and customize for unique workflows. A subsidiary of Constellation Mortgage Solutions, MB is formed to serve the needs of lenders from start-up to closure and service. The MB platform is a complete solution backed by its award-winning customer service. Since 1999, it has been working to help today’s mortgage professionals streamline their operations, reduce costly mistakes that can lead to regulatory issues, and close more loans faster to improve ROI.

#14 MeridianLink Mortgage

MeridianLink Mortgage, formerly known as LendingQB, is a lending solution designed to help organizations streamline their mortgage lending processes. The platform comes with a rules-based engine that allows users to automate a variety of operations including underwriting, product pricing, closing value generation, and more. The platform makes it easy to share information between lenders and borrowers in real-time and allows multiple users to access and edit loan files at the same time. The solution offers many features such as credit report analysis, historical pricing, alerts, automatic costing, application monitoring, POS providers, and more.

The TPO portal allows third-party initiators to upload and create loan requests, run automated underwriting systems, and track applications throughout the pipeline. The platform also includes an eDocs module that allows administrators to collect, publish, edit, and merge loan application documents. Through the platform’s consumer portal, borrowers can upload confirmation files and track the status of their applications. In addition, alarm reporting and permanent stop features enable users to enforce credit compliance. It integrates with a variety of third-party systems including customer relationship management (CRM), accounting, service platforms, and more.

#15 Abrigo Sageworks Lending

Abrigo Sageworks Lending Solution enables many banks and credit unions to grow their loan portfolios to thrive in a highly competitive and highly regulated environment. It allows banks and credit unions to book loans faster without compromising on portfolio quality. Every loan made through this platform can be analyzed, developed, and evaluated faster with automated templates and rules that ensure consistency and thorough documentation. Sageworks’ web-based lending, credit, and portfolio risk management suite are designed to help local banks and credit unions compete in today’s banking environment. The salient features of the platform include Dashboard, Document Management, Loan Processing, Online Applications, Pipeline Management, and Risk Management.

#16 Optimal Blue Loansifter

Optimal Blue Loansifter is a solution that drives the digital marketplace for the mortgage industry that connects lenders, investors, and providers through comprehensive secondary marketing solutions, market-leading opportunities, and value-added services that deliver results. At the heart of its marketplace is a shared repository of searchable and actionable loan programs and loan-level pricing data used in real-time by more than +160,000 users, +1,600 customers, and +160 investors.

Its robust credit analysis, blocking workflow, and risk management features enable lenders to instantly identify and act on “really best execution” across all quotation, blocking, and delivery channels. In addition, its extensive library of application programming interfaces (APIs) enables automatic communication between the digital marketplace and the systems used by lenders for lead generation, marketing, and lending.